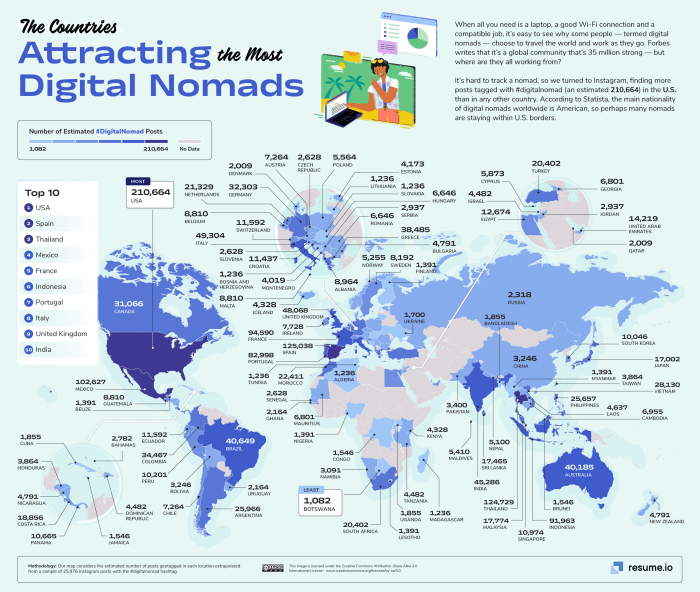

Embark on a journey through the world of Life Coverage Plans for Digital Nomads, where the necessity of securing insurance meets the unique lifestyle of remote workers and frequent travelers. This overview promises a blend of informative insights and practical advice to guide you in making the right choices.

Delve deeper into the types of plans available and the essential factors to consider before diving into the realm of Life Coverage Plans for Digital Nomads.

Overview of Life Coverage Plans for Digital Nomads

Life coverage plans for digital nomads are insurance policies designed to provide financial protection and security for individuals who work remotely and travel frequently. These plans typically offer coverage for life insurance, disability insurance, and other related benefits to ensure that digital nomads and their families are protected in case of unforeseen circumstances.

Importance of Life Coverage for Digital Nomads

Life coverage is essential for digital nomads due to the unique lifestyle they lead. Working remotely and traveling frequently can expose them to various risks and uncertainties, making it crucial to have a safety net in place. Life coverage plans provide financial support in the event of accidents, illnesses, or even death, ensuring that digital nomads and their loved ones are financially protected.

Challenges Faced by Digital Nomads

Digital nomads face a set of challenges that make life coverage plans a necessity. Constantly changing environments, lack of access to traditional healthcare systems, and the absence of job security are just a few examples of the hurdles digital nomads encounter.

Having a comprehensive life coverage plan can help mitigate these risks and provide peace of mind while pursuing a location-independent lifestyle.

Types of Life Coverage Plans Available

Life coverage plans for digital nomads come in various types to cater to different needs and preferences. It is essential to understand the features of each type to make an informed decision on the best plan for your lifestyle.

Term Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It offers a death benefit to your beneficiaries if you pass away during the term of the policy. This type of insurance is often more affordable compared to other options, making it a popular choice for digital nomads who want protection for a specific period.

Whole Life Insurance

Whole life insurance provides coverage for your entire life as long as premiums are paid. It also includes a cash value component that grows over time. While whole life insurance tends to have higher premiums, it offers lifelong protection and a savings element that can be beneficial for long-term financial planning.

International Coverage

For digital nomads who travel frequently or reside in different countries, international life insurance provides coverage regardless of your location. These plans are designed to offer protection globally, ensuring that you are covered no matter where your travels take you.

This type of coverage can be essential for those leading a nomadic lifestyle.

Specialized Plans for Digital Nomads

Some insurance companies offer specialized plans tailored to the unique needs of digital nomads. These plans may include features such as flexible premium payments, coverage for specific activities or locations, and benefits that cater to the mobile lifestyle of digital nomads.

Examples of insurance companies that offer specialized plans for digital nomads include SafetyWing, World Nomads, and Clements Worldwide.

Factors to Consider When Choosing a Life Coverage Plan

When selecting a life coverage plan as a digital nomad, there are several key factors to keep in mind to ensure adequate protection and flexibility for your unique lifestyle.

Coverage Limits and Benefits

- Consider the coverage limits offered by the plan to make sure it aligns with your financial obligations and future needs.

- Examine the benefits provided, such as payouts for critical illnesses or disabilities, to ensure comprehensive coverage.

- Look for plans that offer flexibility to adjust coverage as your circumstances change.

Premiums and Affordability

- Evaluate the premiums required for the coverage and ensure they fit within your budget as a digital nomad.

- Compare quotes from different providers to find a balance between affordability and adequate coverage.

- Consider the impact of your lifestyle on premium rates, especially if you frequently travel to high-risk areas.

Global Coverage and Flexibility

- Opt for a plan that offers global coverage to protect you no matter where you travel as a digital nomad.

- Ensure the plan allows you to make changes or updates easily, considering the unpredictable nature of your lifestyle.

- Look for policies that provide flexibility in terms of payment frequency, coverage adjustments, and beneficiary changes.

Tips for Maximizing Benefits from Life Coverage Plans

Having a life coverage plan as a digital nomad is crucial for ensuring financial security and peace of mind. Here are some tips to help you maximize the benefits of your life coverage plan:

Regularly Review and Update Your Life Coverage Plan

It's important to review and update your life coverage plan regularly to ensure it aligns with your current needs and circumstances. Life changes such as marriage, starting a family, or changing career paths can impact the adequacy of your coverage.

By reviewing and updating your plan, you can make sure you have the right amount of coverage to protect yourself and your loved ones.

Integrate Life Coverage Plans with Your Financial and Travel Plans

Integrating your life coverage plan with your overall financial and travel plans can help you make the most out of your coverage. Consider factors such as your budget, long-term financial goals, and travel destinations when selecting a plan. This will ensure that your life coverage plan complements your lifestyle and provides the necessary protection wherever you go.

Epilogue

In conclusion, navigating the realm of Life Coverage Plans for Digital Nomads requires careful consideration and strategic planning. By maximizing benefits and staying informed, digital nomads can ensure a secure future amidst their global adventures.

Frequently Asked Questions

What are the main types of life coverage plans suitable for digital nomads?

There are various types such as term life, whole life, and international coverage, each catering to different needs and preferences.

How does the lifestyle of a digital nomad influence their choice of a life coverage plan?

The nomadic lifestyle often involves higher risks and uncertainties, impacting the coverage needs and priorities of digital nomads.

Why is global coverage important for life coverage plans for digital nomads?

Global coverage ensures protection across borders, reflecting the international nature of a digital nomad's lifestyle.