Delving into Comparing Life Assurance and Life Insurance: Know the Difference, this introduction immerses readers in a unique and compelling narrative, with a casual formal language style that is both engaging and thought-provoking from the very first sentence.

Exploring the nuances between life assurance and life insurance sheds light on the complexities of financial protection, guiding individuals towards informed decisions for their future.

Understanding Life Assurance and Life Insurance

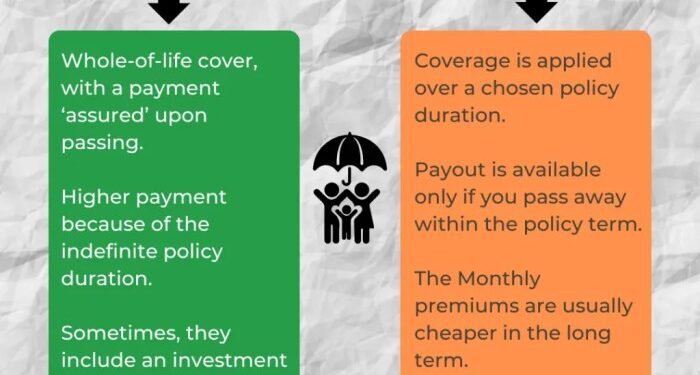

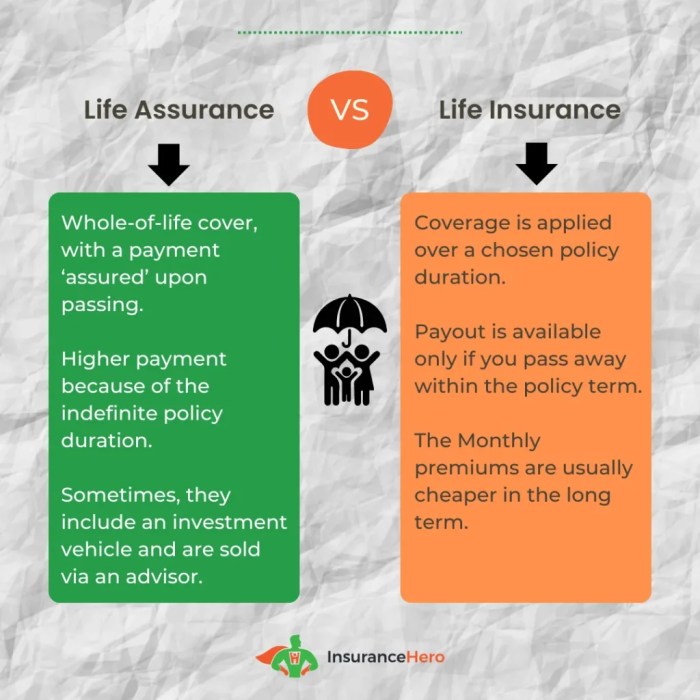

Life assurance and life insurance are both financial products designed to provide protection and financial security to individuals and their families in the event of death. However, there are key differences between the two that are important to understand.Life assurance is a long-term insurance product that provides coverage for the entire lifetime of the policyholder.

It guarantees a payout upon the policyholder's death, regardless of when that may occur. On the other hand, life insurance typically provides coverage for a specific term, such as 10, 20, or 30 years, and only pays out if the policyholder passes away during that term.One key difference between life assurance and life insurance is the certainty of payout.

With life assurance, the payout is guaranteed as long as the policyholder continues to pay the premiums. In contrast, life insurance may not pay out if the policyholder outlives the term of the policy.In situations where long-term financial protection is needed, such as providing for dependents or covering estate taxes, life assurance may be more suitable.

Life assurance can provide peace of mind knowing that there will be a guaranteed payout to beneficiaries whenever the policyholder passes away, regardless of when that may happen.

Examples of Situations Where Life Assurance is More Suitable

- Providing financial support for dependents for the rest of their lives

- Ensuring payment of estate taxes and other financial obligations upon death

- Leaving a legacy or inheritance for future generations

Coverage and Benefits

Life assurance and life insurance both offer coverage and benefits, but in slightly different ways. Let's explore the specifics of each to understand how they can provide financial protection and security for policyholders.

Coverage Provided by Life Assurance

Life assurance typically provides coverage for a lifetime, meaning that the policyholder is guaranteed a payout whenever they pass away, as long as the premiums are paid. This type of coverage offers a sense of security and peace of mind, knowing that loved ones will receive a lump sum payment upon the policyholder's death.

Benefits of Life Insurance in Terms of Financial Protection

Life insurance, on the other hand, offers financial protection for a specified period, usually between 10 to 30 years. If the policyholder passes away during this period, their beneficiaries will receive a death benefit. This benefit can help cover funeral expenses, outstanding debts, mortgage payments, and other financial obligations, providing a safety net for loved ones during a difficult time.

Comparison of Coverage Options and Benefits

In comparing the coverage options and benefits between life assurance and life insurance, it's important to consider the duration of coverage and the payout structure. Life assurance offers lifetime coverage with a guaranteed payout, while life insurance provides coverage for a specific term with a death benefit payout.

Both types of policies can be valuable tools for financial planning, depending on the individual's needs and circumstances.

Premiums and Payouts

When it comes to life assurance and life insurance, understanding how premiums are calculated and the payout structure is crucial for making informed decisions about your coverage.

Premium Calculation

- Life Insurance: Premiums for life insurance are typically calculated based on factors such as age, health, lifestyle habits, and coverage amount. Younger and healthier individuals often pay lower premiums compared to older or less healthy individuals.

- Life Assurance: Premiums for life assurance are generally higher than life insurance premiums as they factor in investment components and long-term savings. These premiums are determined based on the sum assured, policy duration, and investment performance.

Payout Structure

- Life Insurance: In life insurance, the beneficiaries receive a lump sum payout upon the policyholder's death. This payout is predetermined at the time of policy purchase and is not subject to investment performance.

- Life Assurance: Life assurance policies offer a payout that includes the sum assured plus any investment returns accrued over the policy term. The payout can vary based on the performance of the underlying investments.

Examples

For example, a 30-year-old non-smoker looking for a $500,000 life insurance policy may pay around $30-$50 per month in premiums. In contrast, the same individual seeking a life assurance policy with an investment component may pay higher premiums of $100-$200 per month for the same coverage amount.

Upon the policyholder's death at age 60, the life insurance policy would pay out the full $500,000 to the beneficiaries. On the other hand, the life assurance policy might provide a payout of $600,000, which includes the sum assured plus investment returns earned over the policy term.

Investment Component

Life assurance policies often come with an investment component that allows policyholders to grow their money over time. This investment aspect makes life assurance policies more complex than traditional life insurance policies.

Investment Options in Life Assurance

- Policyholders can choose to invest their premiums in various investment vehicles such as mutual funds, stocks, bonds, or other financial instruments.

- The returns on these investments can accumulate over time, potentially increasing the overall cash value and death benefit of the policy.

- Policyholders may have the flexibility to switch between different investment options based on their risk tolerance and financial goals.

Comparison with Life Insurance

- Life insurance policies typically do not have an investment component and focus solely on providing a death benefit to beneficiaries.

- As a result, life insurance premiums are generally lower compared to life assurance premiums, which include both insurance coverage and investment growth.

- While life insurance offers straightforward protection, life assurance combines insurance coverage with the potential for wealth accumulation.

Implications on Overall Returns

- The investment component in life assurance policies can lead to higher potential returns over the long term compared to traditional life insurance.

- However, the returns are not guaranteed and depend on the performance of the chosen investment options.

- Policyholders should carefully consider their investment choices and risk tolerance to maximize the growth of their life assurance policy.

Outcome Summary

In conclusion, understanding the distinctions between life assurance and life insurance is crucial in securing financial stability and peace of mind. By grasping the intricacies of these policies, individuals can make informed choices that align with their long-term goals.

FAQ

What is the main difference between life assurance and life insurance?

Life assurance typically provides coverage for the entire lifetime of the insured individual, whereas life insurance offers coverage for a specific term.

How are premiums calculated for life assurance and life insurance?

Premiums for life assurance are usually calculated based on the individual's age, health, and the desired coverage amount. Life insurance premiums are determined by similar factors but are often lower for shorter terms of coverage.

Do life assurance policies have an investment component?

Yes, life assurance policies often come with an investment component that allows policyholders to build cash value over time.