Embark on a journey into the realm of Tech-Enabled Life Insurance for Millennials, where the fusion of technology and insurance promises a revolution in coverage. This passage sets the stage for an exploration of innovative solutions tailored to meet the evolving needs of the millennial generation.

Introduction to Tech-Enabled Life Insurance for Millennials

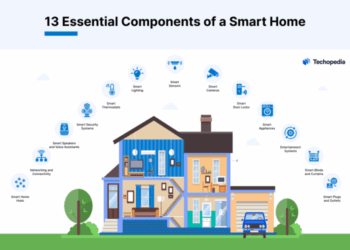

Tech-enabled life insurance refers to the use of technology, such as online platforms, mobile apps, and digital tools, to streamline and enhance the process of buying and managing life insurance policies. This modern approach leverages digital solutions to make life insurance more accessible, convenient, and personalized for consumers.

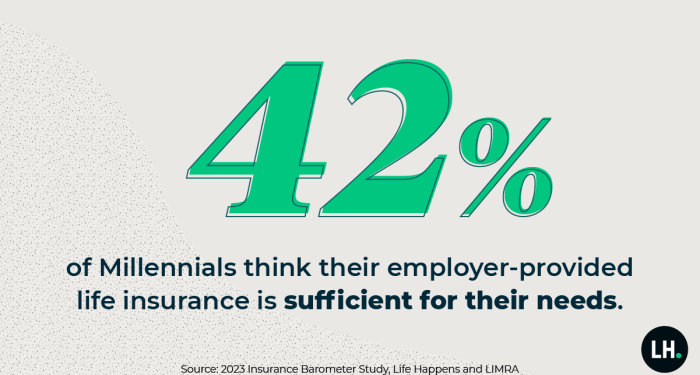

This type of insurance is particularly relevant for millennials, who are known for their digital fluency and preference for seamless online experiences. Millennials value efficiency, transparency, and customization in their interactions with service providers, including insurance companies. Tech-enabled life insurance caters to these preferences by offering easy-to-use digital platforms, instant quotes, and simplified underwriting processes.

How Technology is Transforming the Life Insurance Industry

- Automation: Technology has enabled the automation of various processes in the life insurance industry, such as underwriting, claims processing, and policy management. This automation helps insurance companies reduce operational costs, improve efficiency, and enhance the overall customer experience.

- Data Analytics: Advanced data analytics tools allow insurers to analyze vast amounts of data to gain insights into customer behavior, risk assessment, and market trends. This data-driven approach enables insurers to offer more personalized products and services to millennials based on their unique needs and preferences.

- Online Distribution Channels: Technology has facilitated the rise of online distribution channels for life insurance, making it easier for millennials to research, compare, and purchase policies online. Insurtech startups are leveraging digital platforms to reach a wider audience and provide innovative insurance solutions tailored to the tech-savvy generation.

- Personalized Solutions: By harnessing technology, insurers can collect and analyze customer data to create personalized insurance solutions for millennials. From usage-based insurance to wellness programs, technology enables insurers to offer tailored products that resonate with millennials and address their evolving needs.

Benefits of Tech-Enabled Life Insurance for Millennials

Tech-enabled life insurance offers several key advantages over traditional policies, especially catering to the needs and preferences of millennials.

Convenient Online Access

Tech-enabled life insurance platforms provide millennials with convenient online access to manage their policies, make payments, and access important documents anytime, anywhere.

Personalized Plans

These innovative insurance products use data analytics and AI algorithms to offer personalized plans tailored to individual lifestyles and needs, ensuring millennials get coverage that suits their specific requirements.

Quick and Easy Application Process

With tech-enabled life insurance, millennials can apply for coverage seamlessly online, without the need for lengthy paperwork or medical exams. This streamlined process appeals to the digital-savvy generation looking for efficiency.

Integration with Wearable Devices

Some tech-enabled life insurance products integrate with wearable devices to track health metrics in real-time. This data can be used to adjust premiums based on the policyholder's healthy lifestyle choices, incentivizing millennials to stay active and fit.

Tech Integration in Life Insurance for Millennials

As millennials continue to embrace technology in every aspect of their lives, the insurance industry has also adapted by incorporating various tech innovations to cater to this tech-savvy demographic.

Artificial Intelligence in Underwriting

Artificial intelligence (AI) has revolutionized the underwriting process in life insurance for millennials. AI algorithms analyze vast amounts of data to assess risk factors and determine premiums accurately and efficiently. This not only speeds up the underwriting process but also ensures fair pricing based on individual risk profiles.

Mobile Apps and Online Platforms for Policy Management

Mobile apps and online platforms play a significant role in simplifying policy management for millennials. These tools allow policyholders to view their policy details, make premium payments, file claims, and even contact customer support conveniently from their smartphones or computers.

The accessibility and user-friendly interface of these digital platforms enhance the overall customer experience and encourage millennials to engage more actively with their life insurance policies.

Personalization and Customization in Tech-Enabled Life Insurance

Personalization and customization are key features of tech-enabled life insurance that cater to the needs and preferences of millennials. These innovative solutions allow for tailored insurance plans that align with individual lifestyles and financial goals.

Importance of Customization Options for Millennials in Life Insurance

- Millennials value personalized experiences and products that cater to their specific needs.

- Customization options in life insurance allow millennials to choose coverage that reflects their unique circumstances and priorities.

- By having control over their insurance plans, millennials can feel more engaged and empowered in managing their financial future.

Examples of How Technology Enables Tailored Coverage and Pricing

- Usage of data analytics and AI algorithms to assess individual risk profiles and offer personalized coverage.

- Integration of wearable devices and health apps to track wellness activities and provide discounts or rewards for healthy behaviors.

- Dynamic pricing models that adjust premiums based on lifestyle choices, driving habits, or health outcomes.

- Online platforms that allow for easy comparison of customized insurance options and instant policy issuance.

Challenges and Risks of Tech-Enabled Life Insurance for Millennials

When it comes to tech-enabled life insurance for millennials, there are several challenges and risks that need to be considered to ensure the safety and effectiveness of these digital platforms.

Potential Cybersecurity Risks

In the digital age, storing personal data online opens up the possibility of cybersecurity breaches. Hackers may target life insurance platforms to access sensitive information such as medical records, financial details, and personal data. This poses a significant risk to millennials who rely on these platforms for their life insurance needs.

Ensuring Transparency and Trust

One of the challenges in digital insurance platforms is ensuring transparency and trust among millennials. With traditional face-to-face interactions being replaced by online processes, there may be concerns regarding the transparency of policies, terms, and conditions. Building trust with millennials who are accustomed to quick and accessible information is crucial for the success of tech-enabled life insurance.

Regulatory Issues Impacting Adoption

Regulatory issues play a significant role in the adoption of tech-enabled life insurance among millennials. Compliance with data privacy laws, insurance regulations, and consumer protection measures is essential to safeguard the interests of policyholders. Any regulatory changes or uncertainties can impact the way millennials perceive and engage with tech-enabled life insurance offerings.

Final Thoughts

In conclusion, Tech-Enabled Life Insurance for Millennials offers a glimpse into a future where personalized coverage meets cutting-edge technology. As the landscape of insurance evolves, embracing these advancements ensures a secure and customized path forward for the tech-savvy generation.

Question & Answer Hub

What makes tech-enabled life insurance different for millennials?

Tech-enabled life insurance caters to the digital preferences of millennials by offering streamlined processes and personalized coverage options.

How does technology play a role in transforming the life insurance industry?

Technology enhances the efficiency of underwriting processes, simplifies policy management through mobile apps, and offers innovative features for a seamless user experience.

Are there any risks associated with tech-enabled life insurance?

Potential cybersecurity threats pose a challenge, requiring robust measures to protect personal data stored online.